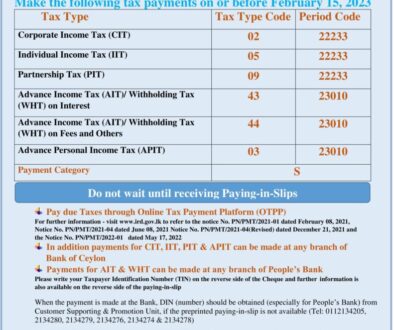

Extension of Time to Remit Tax to the Inland Revenue Department

Extension of Time to Remit Tax to the Inland Revenue Department

Any amount retained by the Employees’ Trust Fund (ETF) Board, any Provident

Fund or Employer as per the Circular No. SEC/2020/02 of the Commissioner

General of Inland Revenue, dated 18.02.2020 as income tax on terminal benefits due

for the retiring employees for which such employees were required to produce a

Direction from the Inland Revenue Department (IRD) within 90 days from the date

of such retention of tax, and if that 90 days period expires on or after 06-10-2020,

such 90 days period for retention of tax deducted by the ETF Board, any Provident

Fund or Employer, has been extended up to 31st December, 2020, considering the

COVID-19 pandemic situation prevailing in the country.

Commissioner General of Inland Revenue